“History doesn’t repeat itself but it often rhymes” – Unknown

In February 2018, we sent out our weekly brief after a week where the DOW experienced two 1000-point drops (the first ever time the DOW had fallen over 1000 points). Two years later, we find ourselves in a similar situation.

Before reading about this week’s events, I would encourage you to read our February 2018 article. There are many common themes and it provides a good historical perspective on how ordinary these events are.

The Friday session has not ended yet, but the DOW Jones, the U.S. Index representing 30 of the largest American corporations, is currently hovering around the 25,000-point mark. Last Friday, it closed at just under 29,000. In one week, it has fallen ~16% and markets have reverted to around the August 2019 mark.

This week’s events were fueled by new cases of the Coronavirus around the world and fears of a global epidemic. After Monday and Tuesday’s drops, we sent out a special brief on Wednesday discussing these events.

Again, this is all reminiscent of February 2018, where two 1000-point drops in one week resulted in a 10% drop for the DOW and a resetting of prices back a few months.

A Historical Look at Previous Epidemics

We would like to remind you of previous epidemics and their effect on markets. Looking back 40 years, previous epidemics have all led to the S&P 500 increasing in value over the six months after the virus was discovered, except for the HIV/AIDS epidemic in 1981. Even then, the decline was minimal. Over 12 months, there were only two instances of the market declining after the disease was discovered.

There is a possibility that the coronavirus impacts the global economy more than previous epidemics; however, the stock market’s track record of a quick recovery from these events can be reassuring.

Market Declines are Common

The DOW has increased from a March 2009 (Financial Crisis) low of about 7,000 to 25,000 today (or 29,000 last week). That is a 300-400% increase in 11 years. During those 11 years, there were 18 instances where it fell 5% or more. Historical patterns suggest we should expect events like this around twice per year.

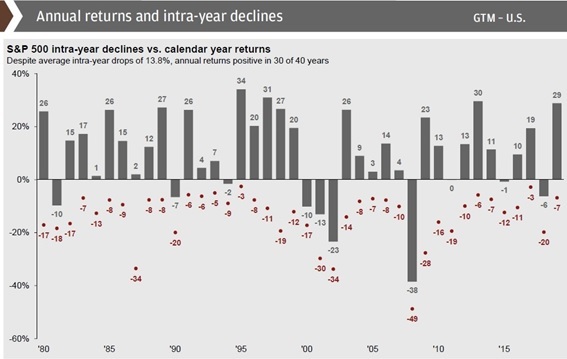

In the past forty years, the average intra-year decline for the S&P 500 is 14%. Even last year when it returned 29%, it fell 7% at one point during the month of May.

Your Portfolio is Well-Diversified

This week’s volatility reinforces the importance of diversification. The DOW is down 16% in one week, some tourism-sensitive companies like airlines fell over 20% this week and are down as much as 35% since the start of the year.

In contrast, your portfolio likely absorbed only half of this week’s DOW decline and sits down about -3% for the year. Your investments are well-diversified by industry, by geography, and by asset class (equities and fixed income), which lowers your overall risk and smooths out your return stream. In the past several meetings and during our market briefs, we have discussed the length of this market cycle and cautioned against ever-increasing recession risks. Our outlook and positioning for the past few years has been more cautious than usual, especially for clients who are drawing down their portfolio.

Conclusion: The Short-Term is Unknown and Scary but the Long-Term Trend is Clear

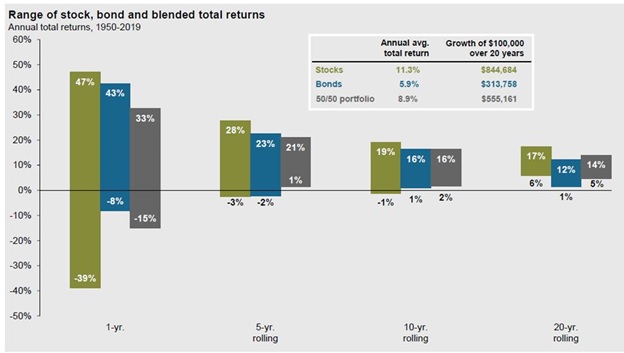

Like you, I don’t know how long this lasts or how bad it will get. But I do know what the past 70 years have looked like. The chart below shows that the historical worst case 1-year rate of return for equities is -39%, but the worst case over 10 years is -1%. Most of our investing time horizons are in the 10+ years range, and I’ll take those odds every time.

Please feel free to contact us anytime with any questions or comments.