Miles Zyblock, Chief Invesment Strategist with Dynamic Funds, released an interesting article this week.

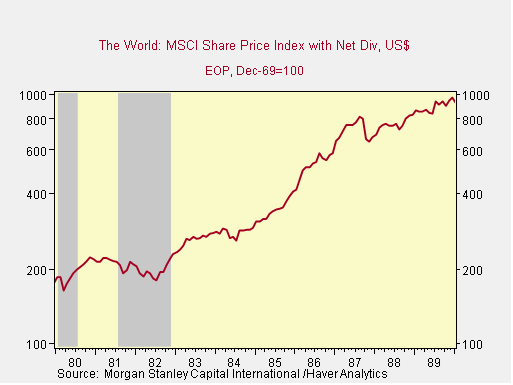

The summary is that the U.S. and Japan were entrenched in their own trade war during the 80s, which took 12 years to settle. Despite the trade tensions, it was a pretty good decade for markets.

In other words, capital markets are complex. No single-issue drives performance, there are a variety of data points to consider.

The article is below.

Remembering the 1980s

Last time there were trade wars to any significant extent was throughout the 1980s, largely between the U.S. and Japan.

Speaker of the House Tip O’Neill threatened to “fix the Japanese like they’ve never been fixed before”

President Reagan asserted that he was trying ”to enforce the principles of free and fair trade,” by imposing a 100 percent tariff on some Japanese-made computers, television sets and power tools.

William R. Cline, senior fellow at the Institute for International Economists in Washington, said trade barriers ”run the risk of escalation, with the resulting closure of trade on both sides.” He said, ”This happened in the 1930’s and deepened the Depression.”

Concerns about industrial espionage were widespread: six Hitachi executives were arrested by a FBI sting operation relating to IBM technology. Fujitsu was blocked from acquiring Fairchild Computer on national security grounds.

Autos, steel, technology and consumer electronics were just a few industries targeted.

The two countries ultimately reached an accommodation, largely through Japanese concessions. It took a dozen years to settle.

Trade frictions were defused by a combination of “voluntary” export quotas, penalties under “Super 301” legislation (a unilateral process for targeting nations supposedly guilty of unfair trade), a large-scale shift of Japanese auto manufacturing from Japan to the U.S., and liberalization of Japanese imports in previously protected areas. There was also a huge managed revaluation of the yen which blunted Japanese competitiveness.

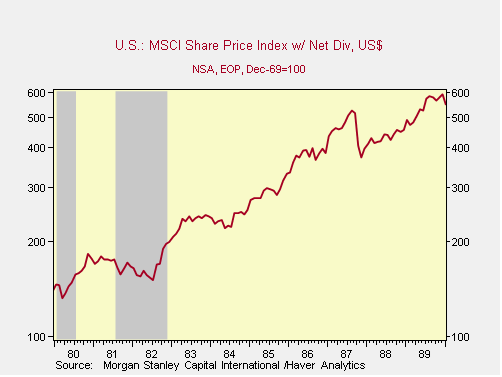

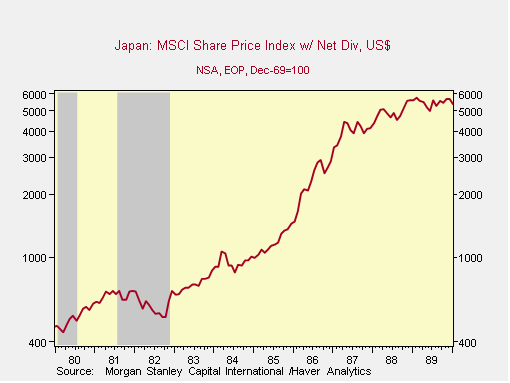

Through all of this, the 1980s was a pretty good decade for stocks in the US, Japan and across the globe outside of a rough start due to double-dip U.S. recession (shading for U.S. recessions) and the 1987 crash.

On behalf of the entire You First team, Happy Canada Day!

Source: Dynamic Funds