On Wednesday April 2nd – after market closing – the United States formally implemented a sweeping new series of tariffs on nearly all U.S. trading partners, marking the most dramatic shift in American trade policy since the Trump administration’s first term. The new tariffs resulted in the sharpest negative market reaction since the start of the Tariff saga. The TSX (Canadian index) and S&P 500 (U.S. index) declined 3-4% on Thursday and another 3-4% early in the Friday trading session.

The S&P 500 (U.S. market) has fallen around 1000 points from the all-time high of 6,147 reached on February 19. That’s a decline of around 16%.

TSX (Canadian market) has fallen around 2600 points from the all-time high of 25,875 reached on January 30. That’s a decline of around 10%.

International (Europe and Asia) markets have fared better in 2025, and are flat for the year.

The new tariffs are being imposed under the International Emergency Economic Powers Act (IEEPA) of 1997, with the U.S. trade deficit declared a national emergency. Beginning April 5, a 10% base tariff will be applied to all U.S. imports. Then, starting April 9, higher, country-specific reciprocal tariffs will take effect, aimed at nations with significant trade surpluses with the U.S. These include China (54% tariff, combining a 34% increase with the 20% tariff imposed earlier in the year), the European Union (20%), Vietnam (46%), among others.

Notably, Canada and Mexico are exempt from both reciprocal tariffs and the 10% baseline tariff as both nations will continue to pay tariffs under the IEEPA order related to border security. As per the Executive Order, this equates to 25% tariffs on all non-USMCA compliant exports.

Estimates suggest this announcement increases the US’s average tariff rate to above 20%, a level not seen since the early 1900’s. Last year, it was 2.5%.

How long will Tariffs last?

While there is now greater clarity on the depth and breadth of the U.S. administration’s tariff policy, the big unknown – and arguably the most important factor – remains the duration for which these tariffs will remain in place.

There is no logical economic explanation behind these measures, and despite yesterday and today’s market reactions, investors remain skeptical these tariffs will remain in place in the long-run.

In a Globe & Mail article titled “Why the stock market doesn’t actually believe Trump will tank the economy”, Tim Shufelt, investment reporter, writes the following:

But financial markets don’t believe Mr. Trump’s new tariffs will be here to stay. Rest assured, it would have been a far worse trading day if they did. The S&P 500 index of American blue-chips ended Thursday down by 4.8 per cent. About US$2.5-trillion was wiped out from U.S. exchanges, according to Dow Jones Market data. The losses radiated out to Canadian and global stocks, as well as a range of commodities from oil to gold, and the U.S. dollar. It was the worst single-session wipeout since the early days of the COVID-19 pandemic. Not a good day on Wall Street, by any measure. But nothing on the scale of economic carnage Mr. Trump’s plan would unleash.

Astonishing tariff rates were announced on Wednesday, including 34 per cent on goods from China. That’s on top of previously announced levies of 20 per cent, taking China’s base rate to 54 per cent, before factoring in existing tariffs imposed by previous administrations. Enacting all of Mr. Trump’s new duties would take the average U.S. tariff rate up to 29 per cent, Evercore ISI estimated. Last year, it was 2.5 per cent. Now consider that the U.S. imported US$3.3-trillion of goods last year, and you start to get the sense of what’s at stake.

Economists are mostly flying blind these days. Bank of America estimated that the hit to U.S. corporate earnings could range from 5 per cent to 35 per cent. Mr. Trump has made the future unforecastable.

But a global recession this year would be a sure thing if those gigantic tariffs are put in place indefinitely. It takes a lot to tip the entire world economy into a serious downturn. Only twice in the past 20 years have we seen shocks big enough to do the trick: the pandemic and the global financial crisis of 2008-09.

The worst trading days in those episodes saw U.S. indexes fall by 10 to 12 per cent.

Within the United States, Trump seems to be doing his best to make stagflation – the dreaded combination of inflation and recession – a reality. On both counts, the economic indicators are turning in the wrong direction, fast. The President’s hope is that a rewriting of the rules of global trade will lead to a domestic manufacturing renaissance. The crucial question of the moment: Is Trump really willing to torpedo the American economy to do so? Or is this more of his relentless brinkmanship?

Wednesday’s stunt reeks of the latter. Consider how the new tariffs were calculated. They aren’t based on tariffs other countries have imposed on the U.S. Instead, they are derived from trade deficits, punishing countries for exporting more to the U.S. than they import. China’s trade deficit of US$291.9-billion, for example, is 67 per cent of the goods it exports to the United States. Divide that by two, and you get a 34 per cent tariff.

The math is idiotic, and it somehow leads to tariffs on remote islands inhabited only by penguins. Meanwhile, Lesotho, one of the poorest countries in the world, is facing a tariff of 50 per cent.

Does this seem like the kind of carefully crafted plan worth sacrificing the U.S. economy for?

The magnitude of damage [these tariffs] could cause to the U.S. economy makes one’s rational mind regard the possibility of them sticking as low,” Bhanu Baweja, chief strategist at UBS Investment Bank, wrote in a note to clients. Eventually, Mr. Trump will have to dial back his trade aggression in order to stabilize the U.S. economy.“

Charts, guidance and perspectives

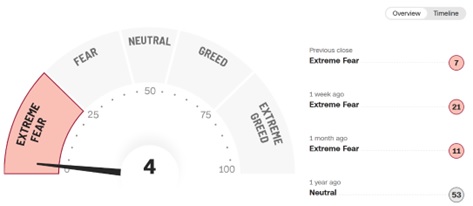

Market sentiment is extremely fearful right now:

The good news is that sentiment is usually a contrarian indicator.

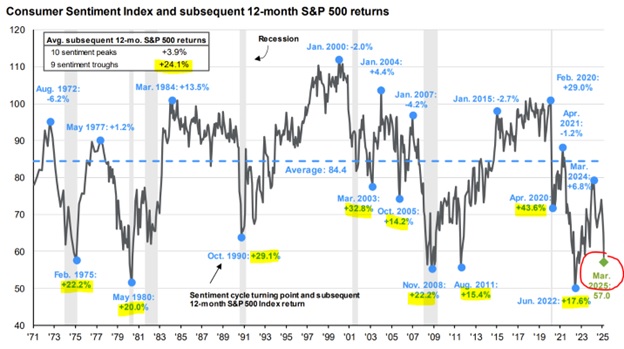

We do not know if sentiment or markets have bottomed out, but here are the subsequent 12-month market returns from similar levels (average of +24% from the worst sentiment level):

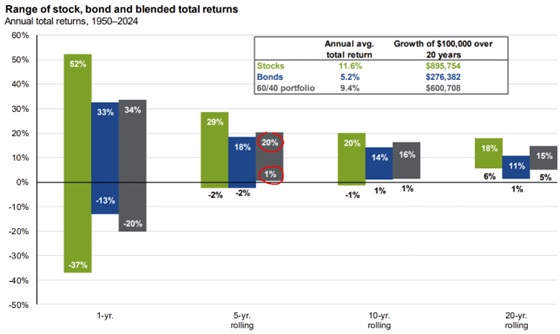

Here’s a chart showing the rate of return from investing in a balanced fund over any 5-year period:

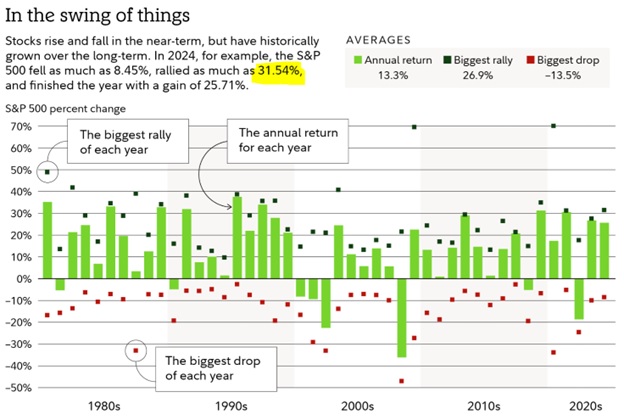

Sentiment can turn quickly (The U.S. administration could quickly change things), and the rally off the bottom could eventually be strong:

We leave you with similar perspectives and guidance as our last article post:

-While this market correction seems unnecessary and self-inflicted, market corrections do happen, and markets eventually recover.

-Take note of the diversification in your portfolio. Your portfolio is likely diversified by asset class, geography and sector. As mentioned, the Canadian and international markets have performed better than the S&P 500 this year.

-For our pre-retired or retired households, we construct portfolios with an upside and downside capture that is suitable based on your cash flow needs, risk tolerance, investment timeline, and overall net worth. There is likely an emphasis on income-generating (i.e. dividend) companies that have lower volatility than the market as a whole. There is likely a healthy safety (cash/GICs) or fixed-income (bonds) sleeve that further mitigate downside risk.

-Market corrections create buying opportunities. Younger investors should view these declines as discounted entry points for their long-term savings.

Our approach remains focused on protecting capital while identifying areas of strength amid volatility, ensuring that portfolios are well-positioned for an uncertain but evolving trade landscape. We welcome the opportunity to review your portfolio, your risk tolerance, and discuss any potential solutions to your concerns. Please do not hesitate to contact us with your questions and concerns, and we will continue to update you with any pertinent market events.

Sources: Globe & Mail, Fidelity Investments, CI Investments.