It’s been a nice couple of years since the 2022 market correction. The S&P 500 (one of the US Indexes) bottomed out at 3,585 in October 2022 and sits at 5,684 as of October 3, 2024. Once again, markets have rewarded investors with a long-term mindset and who do not sell their investments in the middle of a correction.

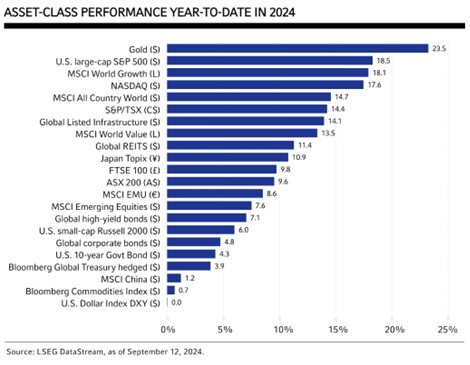

Q3 2024 delivered positive news for investors, with strong gains across most asset classes, though equities experienced greater volatility compared to the first half of the year. Despite this, several underperforming market segments managed to recover, including Canadian equities and bonds, which saw robust performance throughout the period.

A surprise spike in the U.S. unemployment rate contributed to the heightened volatility over the summer. However, with inflation largely contained, the Federal Reserve responded to the worsening labor market by surprising the markets with a 50-basis point rate cut, officially signaling the start of a new monetary easing cycle. This move follows similar actions by other central banks, including the Bank of Canada, which has already implemented three rate cuts in response to a more noticeable weakening in the labor market and inflationary pressures domestically.

Asset Class Performance: Global equities cooled in the second half of 2024, with a notable shift from growth stocks to value stocks. After a strong performance in the first half of the year, most large-cap U.S. tech companies have pulled back since the end of June, despite their solid fundamentals. Meanwhile, U.S. small-cap stocks outperformed over the past three months, driven by rising optimism that the U.S. economy could achieve a soft landing and benefit from lower interest rates.

In fixed income, markets have been buoyant as inflation concerns have receded and the focus has shifted to economic growth. Sovereign yields have declined for the year, with the U.S. 10-year Treasury yield dropping by 0.7% since June. Shorter-term bond yields have decreased even further, reflecting growing market confidence in upcoming central bank rate cuts. While credit spreads have shown some volatility, they remain relatively tight.

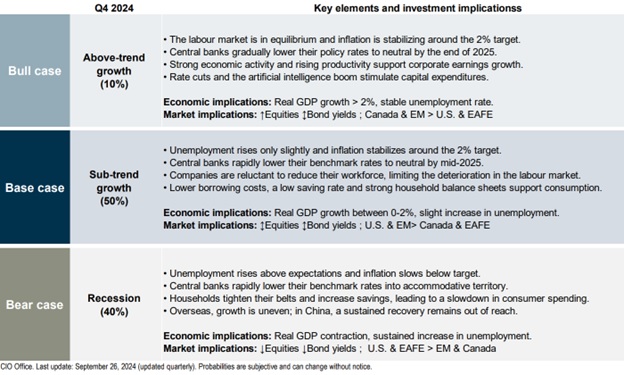

Base-case, best-case, worst-case economic scenarios: The risk outlook has improved compared to the previous quarter, leading to a base case where a recession is now expected to be narrowly avoided. However, while it’s less likely, we can’t completely rule out a more optimistic scenario where economic growth surpasses expectations. That said, the risk of recession remains substantial, particularly due to continued weakness in sectors like construction and manufacturing. Coupled with potential rises in unemployment, this could eventually result in reduced consumer spending, which is key to economic growth. Given these uncertainties, investors should anticipate ongoing equity market volatility in the coming quarters as central banks work to stabilize interest rates at neutral levels – or even lower if economic conditions worsen.

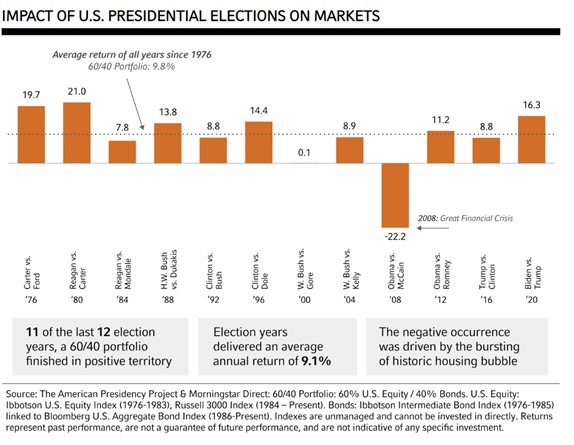

The impact of U.S. elections on markets: Historically, U.S. equities have performed well regardless of the party in power. Diversified portfolios, such as 60/40 allocations, have historically delivered positive returns during most presidential election years, and we expect 2024 to follow a similar path. For long-term investors, the best approach is to stay the course and remain focused on their strategic investment plan.

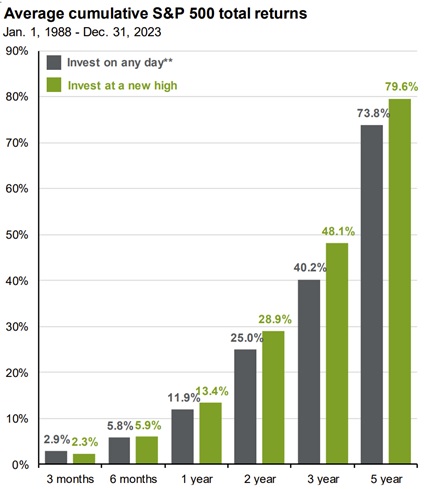

Investing at all time-highs (it’s ok!): Investing at all-time highs has produced better long-term returns than investing on any random day. There’s no question that a lot of positive news has been priced into the valuations and earnings expectations for some of the top names – but that doesn’t mean investors should head for the hills.

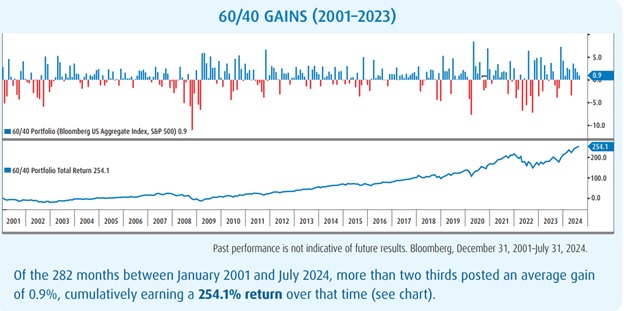

The 60/40 portfolio still delivers persistent gains: The market downturn in 2022 served as a powerful reminder that even well-diversified portfolios carry inherent risks. That year marked the worst performance for the traditional “60-40” portfolio (60% stocks, 40% bonds) since 1974. However, the core principles of sound investing remain intact. Losses incurred by U.S.-based 60-40 portfolios have since been fully recovered, with investors now seeing positive returns. While the exact stock-to-bond allocation within such portfolios may vary, maintaining a balanced approach over the past two decades has consistently proven to deliver reliable returns with reduced volatility, as supported by modern portfolio theory.

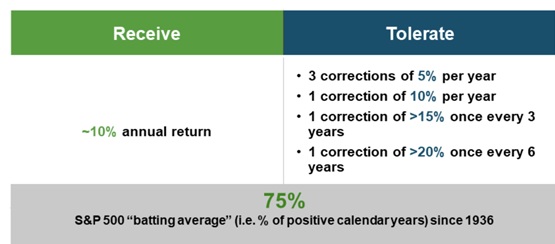

The volatility cost of growth-like returns: A visual reminder to investors that volatility is part of the “deal” of achieving market returns. The U.S. index, as measured by the S&P 500, has historically averaged around a 10% annual return. However, en route to that return, it has averaged three 5% corrections per year, one 10% correction per year, one 15% correction every three years and one 20% correction every 6 years. One out of four years produced a negative rate of return.

Conclusion: We are transitioning from a period of relatively stable markets to one where volatility could increase significantly in the coming years. That’s perfectly fine – that’s what we’re here for. We’re here to help investors cut through short-term distractions and focus on long-term goals. There are still numerous exciting sectors, companies, and investment opportunities ahead.

As always, if you have any questions about your investment or planning strategies, don’t hesitate to contact us.

Sources: Fidelity, BMO GAM, National Bank, Capital Group