Last week, our headline newsletter article “18 Charts for 2022” led with a discussion of the recent market decline. We would like to provide some additional context, courtesy of Dynamic Funds’ Chief Investment Strategist, Myles Zyblock.

Please do not hesitate to contact us with any questions.

Market Volatility: Rough Waters

Equity markets have been rocked in recent weeks. Investors are concerned about monetary policy tightening across the developed world at a time when Omicron has left some economic air pockets and geopolitical tension has escalated due to Russia’s military buildup on Ukraine’s border. The S&P 500 is now in “correction” territory, down by about 12% from its prior peak and taking us back to index levels seen last summer.

Corrections are never easy to stomach. This one might even feel a little harder to endure given the privileged situation we found ourselves in during the prior 15 months of strong returns accompanied by very little price volatility. But, that was far from a normal operating environment.

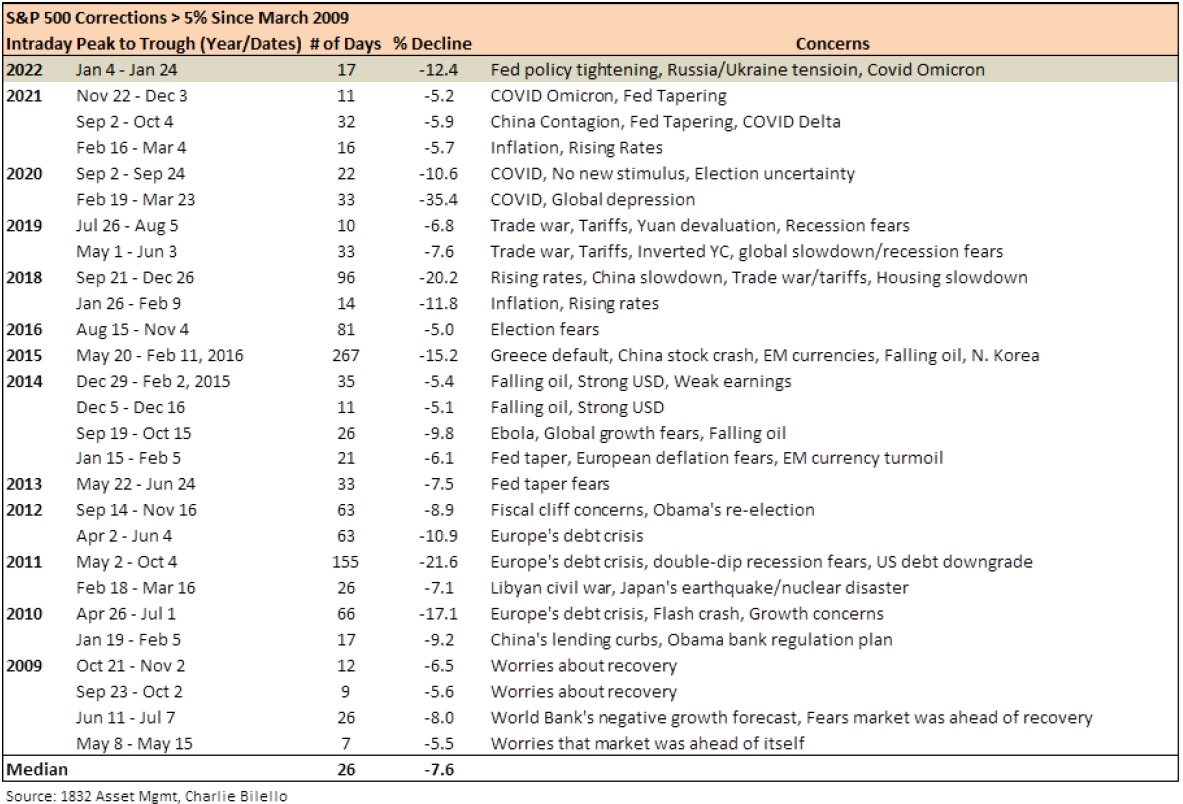

Long-term equity investors carry the scars of time. Since the major low set in March of 2009, the S&P 500 has experienced 26 corrections of at least 5%. This marks the 27th. During those prior episodes of price weakness, 8 exceeded 10% (this is the 9th) with three of those eight taking share prices down by more than 20%. Here’s the important point. The equity market’s annualized return over this entire period has been 17.7%, something that was probably not achieved by any mere mortal trying to time the turbulence. It’s near impossible to anticipate the market’s next move consistently or accurately without the aid of a well-functioning crystal ball.

Appreciating that equity investing carries risk, and that the price path for this asset class is volatile, might help one stay the course when the waters get rough. Perhaps there is some comfort in knowing that price corrections absent economic recession tend to be shallower and shorter in duration than those accompanied by recession. We remain of the view that the odds of economic recession remain relatively low: The yield curve is positively sloped, credit markets are well-behaved, while leading economic data remain comfortably above their “boom-bust” thresholds.

(End of Myles Zyblock commentary)

Sources: Dynamic Funds