You can read Part I of our Coronavirus coverage here

You can read Part II of our Coronavirus coverage here

You can read Part III of our Coronavirus coverage here

You can read Part IV of our Coronavirus coverage here

Click here for a summary of all cash flow solutions made available by companies or government

Click here for an update on tax season

In a few short weeks, the COVID-19 pandemic has impacted the world in ways we could never have imagined. The priority continues to be the health and safety of our clients and staff.

We understand the concern you are experiencing right now as you wonder about the state of your investments and what impact this situation will have on your financial future. We would like to assure you of two things: first, this is expected to pass; second, your portfolios are well-positioned to get through this.

As always, the You First team is here to support you. Please do not hesitate to contact us with your questions or concerns.

What happened this week?

Monday, March 23rd marked the short-term low for markets. After Monday’s closing, both the Canadian and US markets were down -37% from their February 21st peaks. Since then, markets have rallied, largely in response to healthy aid and stimulus packages announced by governments worldwide. Canada doubled its aid package to 52 billion and the 2 trillion USD budget plan is the most ambitious ever proposed in U.S. history.

As of Thursday closing, North American markets are now down about -25% from their February 21st peaks. This week’s rally is also being attributed to end-of-month rebalancing by pension and institutional funds.

Most long-term portfolios under our management are absorbing 60-80% of the decline.

Where do we go from here?

This week’s rally should not be interpreted as an “all clear” signal. As written in a previous entry, markets seesaw on the way down and on the way up and one week does not make a trend. Monday’s low may be revisited or surpassed.

Markets have seen supportive central bank and government policy, but now we must wait for the third major element – COVID case data. The next 4-8 weeks will be critical in determining the extent of cases in the U.S. and the rest of the world. The situation appears to be stabilizing in Italy, but it’s markedly deteriorating in the United States. India, the second most populous country on the planet with a population of 1.4 billion, has imposed a total ban on venturing out. The logistics of such an undertaking must be extraordinary, to say the least.

929,000 EI applications were processed last week (March 16-22), compared to 27,000 for the same time period last year. Big Banks say they have fielded a total of 200,000 mortgage deferral requests.

Conclusion

Conclusion number one is that this story needs more time to play out before we can begin to gauge the long-term economic effects. A 2-3-month bull-bear-bull transition would be historically unprecedented and there is still strong downside risk in the months to come.

Conclusion number two is that change is the only constant we have in our society. While each new crisis feels unprecedented and apocalyptic, the past 100 years of investment history tells us that the market goes through cycles, with slow accumulation of value followed by sharp periodic declines. We construct portfolios with these events in mind and we continue to emphasize the importance of remaining invested, diversified, and disciplined.

Whatever our post-COVID19 world looks like, we’ll still need to produce knowledge and goods. Some companies will be challenged in this new environment, others may thrive, and most will likely go on as usual.

This message is in no way meant to diminish the potential human and financial impact of the COVID-19 virus. However, from a long-term investment perspective, we continue to view the current market shock in the same vein as previous ones. That is, we expect a much more pronounced short-term effect than a permanent one.

Charts of interest

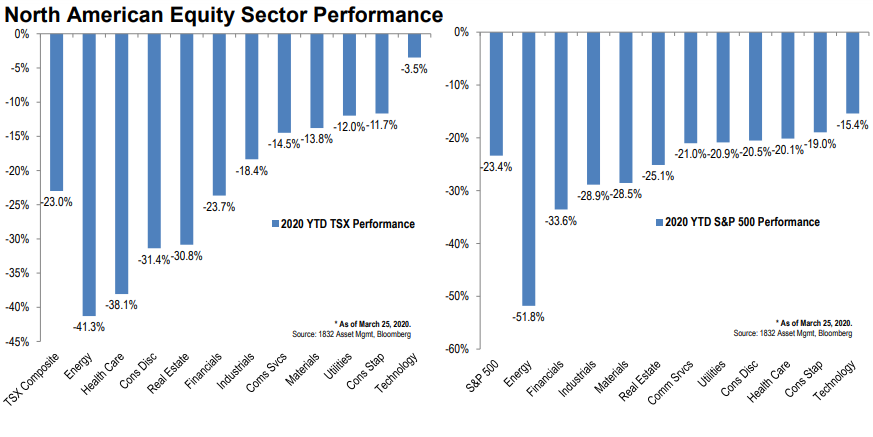

It has been hard to find a market that is in positive territory over this period.

Energy, Health Care and Consumer Discretionary have been the biggest laggards among the TSX sectors. At the other end of the performance spectrum, Technology, Consumer Staples and Utilities have been the leaders.

The S&P 500 has declined 23.4% in 2020. Energy, Financials and Industrials have weighed on the U.S. benchmark while Technology, Consumer Staples and Health Care have fared a little better.

In the current risk-off environment, government debt have led the way within the fixed income pool of assets. U.S. and Canadian longer-dated Treasuries have returned 19.3% and 8.6%, respectively.