In 2012, new rules were introduced that allowed Canadians to apply for CPP benefits as early as age 60 at a reduced rate, or as late as 70 at an increased rate. This was meant to address Canada’s evolving landscape of retirement, with some Canadians retiring before age 65 while others are working past it.

Using the age 65 benefit as the base amount, the reduction for application before your 65th birthday is 0.60% per month, or up to 36% lower if you are applying at age 60. The increase for application after your 65th birthday is 0.70%, or up to 42% higher if you apply at age 70.

In other words, if you are eligible for $1,000 a month at 65, you can choose to apply for and receive a benefit of $640 at age 60, or $1,420 at age 70.

So, what should you do?

As usual, there is no single answer for everyone. The main factor is longevity, but there are other considerations such as taxes, GIS/OAS eligibility, whether you are still working from 65-70, or whether expenses will be much higher in the earlier stage of retirement.

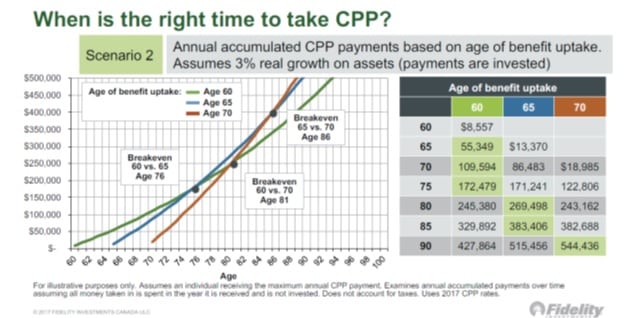

The illustration below looks purely at the lifetime accumulation of CPP benefits if one decides to apply at age 60, 65, or 70. It assumes that the benefits received are invested and earning 3% a year. The chart on the left plots the break-even points and the table on the right provides lifetime totals for the three different application ages.

The break-even point for age 60 vs. 65 CPP application is age 76. In other words, the cumulative payments of a person who applies for CPP at 65 will catch up to the ones for a 60-year-old at age 76. By age 90, the age 65 applicant will have received an additional $87,000 in benefits than the age 60 applicant.

Therefore, if you live past age 76, you will receive a larger CPP payout applying at 65 than at age 60. Again, there are other factors to consider and everyone’s situation is different, but most cases we come across argue for an age 65 application instead of age 60.

What about applying age 70 vs. 65? The break-even age for this comparison is age 86. Thus, if you live past age 86, you are better off applying at age 70 than at age 65. Age 86 is close to average life expectancy in Canada and therefore applying at 70 is a riskier bet to make.

Conclusion: Apply at 65, IF you are a healthy person with normal projected life expectancy, IF you are not in OAS/GIS clawback range, IF you are not still working (but talk to us first!)

Other sources supporting deferral of CPP application:

Unconventional Wisdom – Should I delay CPP and OAS until age 70

Globe & Mail – The baby boomers dilemma: When to start collecting CPP

Wealthbar – CPP Benefits – Should you take it sooner or later

CIBC Wood Gundy – Does it make sense to take CPP early

This information is provided for general information purposes only. It does not constitute professional advice. Please contact a professional about your specific needs before taking any action.