After an aggressive rate hiking cycle in both Canada in the United States during 2022, inflation data showed that the rate hikes have been effective. After peaking in the ~9% range, inflation has come down significantly and the Bank of Canada announced recently that inflation is now back at it’s 2% mandated target.

The Bank of Canada has now enacted 3 separate 0.25% rate cuts, and in September, the US Federal Reserve enacted their first rate cut of 0.50%.

Here is a summary of rate cuts to-date both north and south of the 49th parallel.

US Federal Reserve Reduces US Benchmark Rate to 4.75% – 5.00%

The US Federal Reserve enacted their first rate cut on September 18th, with a 0.50% drop. The US benchmark rate lowered from 5.25% – 5.50% down to 4.75% – 5.00%.

“The committee has gained greater confidence that inflation is moving sustainably toward two per cent, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” policymakers on the U.S. central bank’s rate-setting committee said in their latest statement.

This decision, aimed at supporting the labour market amid signs of economic strain, marks the Fed’s first rate cut since the onset of the pandemic. Projections indicated that most officials favoured further cuts in the upcoming meetings, with expectations of an additional percentage point reduction by the end of 2025. The Fed expressed increased confidence that inflation is moving toward its 2% target, while also acknowledging a slight rise in projected unemployment rates. Overall, this move reflects growing concerns about U.S. employment and economic conditions, despite a robust GDP growth forecast and low layoffs.

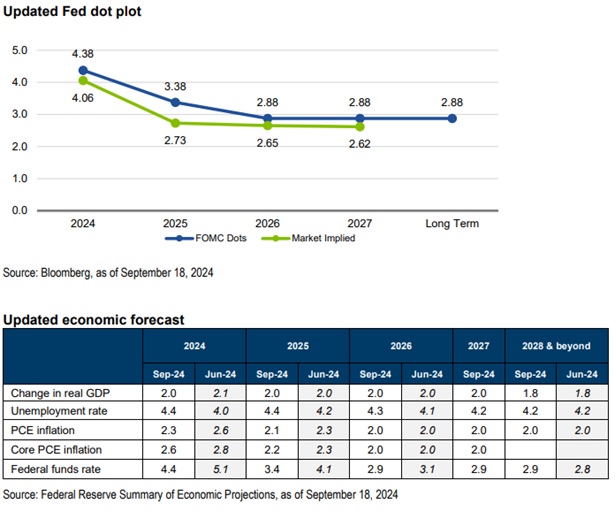

The US Fed rate cut was expected to come in at either 0.25% or 0.50%, so the 0.50% cut was seen as a relatively dovish move. The optimistic reaction on how steadfast the Fed was to support the first hint of slowdown in the labour market was quickly moderated by the disappointing change on the dot plot. The September dot plot suggests that the Fed is ready to have an additional 50bps of cuts for the remainder of this year, 25bps less than what the market has priced in. The difference expands by the end of 2025 where the dot plot suggests an additional 100bps in cuts, 25bps less than what the market is expecting. The quick 50bps cut followed by smaller cuts for the whole year is consistent with the general expectation of a robust U.S. economy and a soft landing, along with further normalization in the labour market, which is anticipated to continue bolstering equities. In addition, the start of the cutting cycle should present more opportunities for fixed income investors. Despite potential volatility stemming from the U.S. election, the combination of moderating inflation, easing monetary policies, along with strong forward-looking corporate earnings growth for both 2025 and 2026, is creating the goldilocks scenario for risk assets.

Bank of Canada Reduces Overnight Rate by 25bps to 4.25%

On Wednesday September 4th, the Bank of Canada Governor Tiff Macklem announced the 3rd policy rate reduction in 2024. This rate cut was for 0.25%, with the overnight rate dropping from 4.50% down to 4.25%.

Canada has now had 3 rate cuts in 2024, with each cut being 0.25%. The BoC overnight rate has dropped from 5.00% down to 4.25% so far in 2024.

In the announcement, Macklem cited Q2 economic growth of 2.1%, led primarily by government spending and business investment. The July inflation report showed further slowing down to 2.5% (August inflation report later showed additional slowing down to 2%).

Broad inflationary pressures, such as excess supply in the economy, have put continued downward pressure on inflation figures, as we can see playing out in the August inflation data.

Where do rates go from here?

Naturally, plans can change but right now, inflation is under control and the primary concern has shifted toward recession mitigation. The US Fed and the BoC need to carefully balance keeping inflation in line without stifling economic growth. Since inflation is largely under control, it is a good bet we’ll see additional cutting going forward.

In the US, the Fed has signaled additional rate cuts of up to 0.50% in the remainder of 2024, with additional cuts to come in 2025.

In Canada, the expectation is for an additional rate cut in October, in the range of 0.25% to 0.50%, as well as the possibility of additional cuts throughout 2025.

Please let us know if you have any questions about interest rates going forward.

Sources: Bank of Canada, US Federal Reserve, NEI Investments, CBC.ca