Tax planning is a continuous process, but the start of the year presents a prime opportunity to review your finances and maximize any available tax-saving strategies.

As we enter 2025, here are some key tax tips to consider.

Create a CRA My Account

Do you have a CRA My Account yet? Here are some of the tools are your disposal with CRA My Account:

- Access tax slips (T4, T5, RRSP contribution receipts, etc), and Notices of Assessments (NOAs) going back 10 years

- Confirm RRSP (including Homebuyer’s Plan balance) and TFSA space

- Transfer tax instalments from one tax year to another

- Submit documents required to satisfy a CRA review

- View CRA transaction history

- View unclaimed CRA payments

You can register for a CRA My Account here.

Understand your Marginal Tax Bracket (MTR)

Should I contribute to TFSA or RRSP? Should I contribute to my RRSP now or in the future? Should I gift money ahead of death? Should I draw funds out of my corporation? The answer to all these questions is “it depends on your tax bracket”.

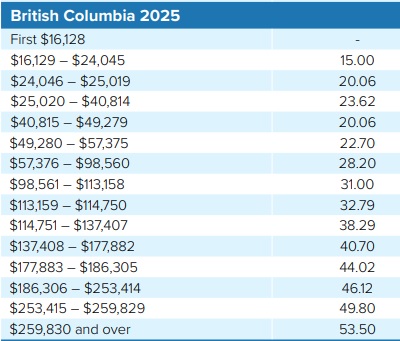

The table above shows the 2025 combined Federal & BC marginal tax rates. Depending on your income, your marginal tax rate can be anywhere from 0% to 53.5%. Note that your marginal tax rate (MTR) is not the same as your average tax rate (ATR). For example, someone earning $300K a year does not pay 53.5% on their entire income. They only pay 53.5% on income exceeding $259,830. On income below $259K, they’ll pay a combination of the various tax brackets you see in each income band. This will result in an ATR of around 36% versus the top MTR of 53.5%.

Registered Plan Contribution Limits

The first step in tax-efficient investing is to make use of your tax shelters. Here are the key figures for 2025:

RRSP

- Contribution limit for 2025: 18% of earned income to a maximum of $32,490

- Contribution limit for 2024: 18% of earned income to a maximum of $31,560

- Contribution deadline for the 2024 taxation year: March 3, 2025

TFSA

- Contribution limit for 2025: $7,000

- Lifetime limit in 2025 for Canadians who were 18 or older when the TFSA was introduced in 2009: $102,000

FHSA

- Contribution limit for 2025: $8,000

- Lifetime contribution limit: $40,000

- Note that FHSA space does not begin accruing until you’ve opened an FHSA. For instance, in the year you open an FHSA, you’re instantly granted that calendar year’s $8,000 contribution limit.

RESP

- Annual grant-eligible contribution limit per child: $2,500, resulting in a 20%, or $500 matching Canada Education Savings Grant (CESG).

- If you have carryforward space, you can contribute $5,000 per child, resulting in a 20%, or $1,000 matching CESG.

The new Capital Gains inclusion rules are likely off the table

Earlier this month, we posted a blog about Prime Minister Trudeau’s resignation, and how his resignation will likely result in the scrapping of the 2/3 capital gains inclusion on gains exceeding $250,000 per person in a calendar year. Most likely, the current 1/2 capital gains inclusion on all capital gains will remain in force.

Manage the OAS Clawback threshold

The Old Age Security (OAS) repayment threshold for 2025 has increased to $93,454 from $90,997 in 2024. Retirees with incomes exceeding $90,997 in 2024 are subject to an OAS recovery tax, calculated at 15% of the amount by which their income surpasses the threshold, up to the total OAS received.

This recovery tax is deducted monthly from OAS payments between July 2025 and June 2026. For 2024, retirees aged 65 to 74 will see their OAS fully clawed back at an income of $148,451, while those aged 75 and older face a full clawback at $154,196.

Bare Trust filing rules

On August 12th 2024, the Department of Finance rolled back the bare trust reporting rules that had been implemented only a year prior. We blogged about the Bare Trust reporting rollback and what to expect going forward.

Based on the amended language, it appears the following types of bare trust will be exempt from the T3 filing requirement:

- Spouses that have a joint bank account for the use and benefit of both spouses

- A parent that is on legal title of a principal residence to allow a child to obtain a mortgage

- An adult child on legal title of a parent’s principal residence

- Spouses that jointly occupy a family home that could be designated as a principal residence, but only one spouse is on legal title

The Canadian Dental Care Plan is open to all (eligible) Canadians

The Canadian Dental Care Plan, which helps cover costs at the dentist’s office for Canadians without insurance, started rolling out in 2024 for seniors and people under 18.

In 2025, Ottawa will open the program to the remaining eligible Canadians. Eligibility requirements include a net family income under $90,000, being a Canadian resident for tax purposes, and having filed a tax return in the previous year.

Between 40% and 100% of eligible costs will be covered, depending on income.

The 2024 Charitable donation deadline is extended to February 28, 2025

Typically, the deadline for making charitable donations that can be claimed for a tax year is December 31 of that year. However, for the 2024 tax year, this deadline has been extended to February 28, 2025.

The government has implemented this extension to address the effects of the four-week Canada Post mail disruption, ensuring donors have adequate time to contribute to Canadian charities.

The new BC Home Flipping Tax takes effect January 1, 2025

Under the proposed rules, homes sold within the first year of being purchased will face a tax rate of 20 per cent of the profit, declining to zero per cent over the second year.

We encourage you to reach out to us about any of these strategies. We’d be happy to review your specific situation.

Sources: Government of BC, Government of Canada, Mackenzie Investments