As we head into a new year, it’s hard not to see echoes of the past. In 2025, the United States will have a new president, though he’s a familiar face. Markets have rallied in anticipation of the incoming administration and its proposed economic policies, much like they did following the 2016 election. The U.S. economy remains resilient, leading the global stage at a time when other regions are struggling.

While this narrative offers hope, it’s impossible to ignore today’s challenges, many of which carry reminders of the past. Much like the Cold War era, U.S. leadership is being tested. Ongoing conflicts in Ukraine and the Middle East, coupled with rising tensions with China, pose risks to global stability. Populist movements are gaining traction, threatening a rollback of free-trade policies.

The outcomes of these developments remain uncertain, but history tells us that macroeconomic instability often brings market volatility. We saw this in 2024 when markets soared to record highs, only to stumble in the summer amid fears of a U.S. economic slowdown. U.S. equity valuations are currently elevated, and prudent investors should prepare for the possibility of a correction. This underscores the importance of a long-term investment approach that balances growth with capital preservation.

There are reasons for optimism about the future of investing — from breakthroughs in artificial intelligence to innovations in health care — but we must remain prepared for potential downturns. Fixed-income, in particular, is poised to play a critical role. With interest rates normalizing, fixed income can once again provide income, diversification, and stability against stock market swings.

The challenges we face are not going away, which is why we emphasize the investment adages of buying quality, being diversified, and adopting a long-term mindset. Market volatility and geopolitical uncertainty are part of the landscape. The worst mistake an investor can make is to step away from the market in turbulent times. Similarly, it’s important to avoid rushing in at market peaks. Keep your goals in focus and avoid being distracted by the daily noise.

This quote from David Sykes, the Chief Investment Officer of TD Asset Management, serves as a good disclaimer:

“If I could emphasize one thing, it is: in investing, it really is about time, compounding, diversification. Making bold predictions and swinging wildly from one asset class to the other is not, in my humble opinion, a way to generate positive consistent returns over time. And if we can focus more on quality, consistency, business models, compounding and time, I think that’s the way you outperform and that’s the way you produce superior investment results.”

At the start of the year, most major investment firms release a 2025 market outlook. If you wish to read these outlooks yourselves, here is a list of our favourites:

- BMO 2025 Market Outlook

- Capital Group 2025 Market Outlook

- IA Clarington 2025 Outlook

- Mackenzie Investments 2025 Outlook

- National Bank Asset Allocation Strategy

- Russell Investments 2025 Global Market Outlook

We read dozens of these recaps and consolidated the key themes into the following article. Part 1 of this guide will serve both as a market summary and a list of tax planning considerations for the year. We’ll cover retirement and estate planning considerations in a follow-up article in the weeks to come.

With that in mind, we encourage you to explore our 2025 market and tax outlook.

MARKETS AND THE ECONOMY

With inflation easing and central banks worldwide lowering interest rates, the global economic outlook remains uncertain as we’ve entered the new year. As in recent years, the United States remains the key driver of global economic activity, while weaker economies in Europe and China work to boost growth.

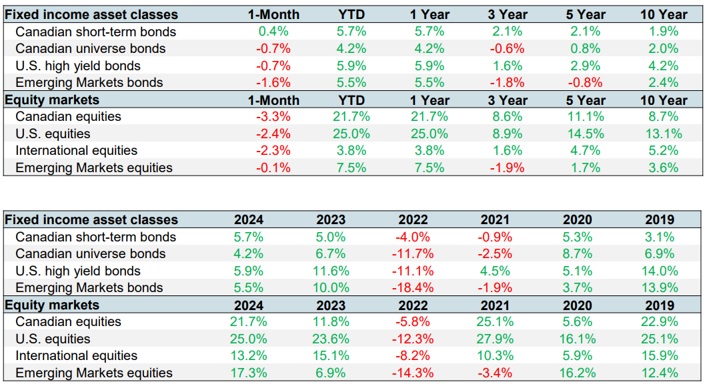

Market Returns

Markets were strong in 2024, with the S&P 500 returning 25% and the TSX returning 22%. Returns have been healthy for the past 15 years going back to the 2009 Financial Crisis bottom-out. The U.S. market has led the way on the strength of its technology sector.

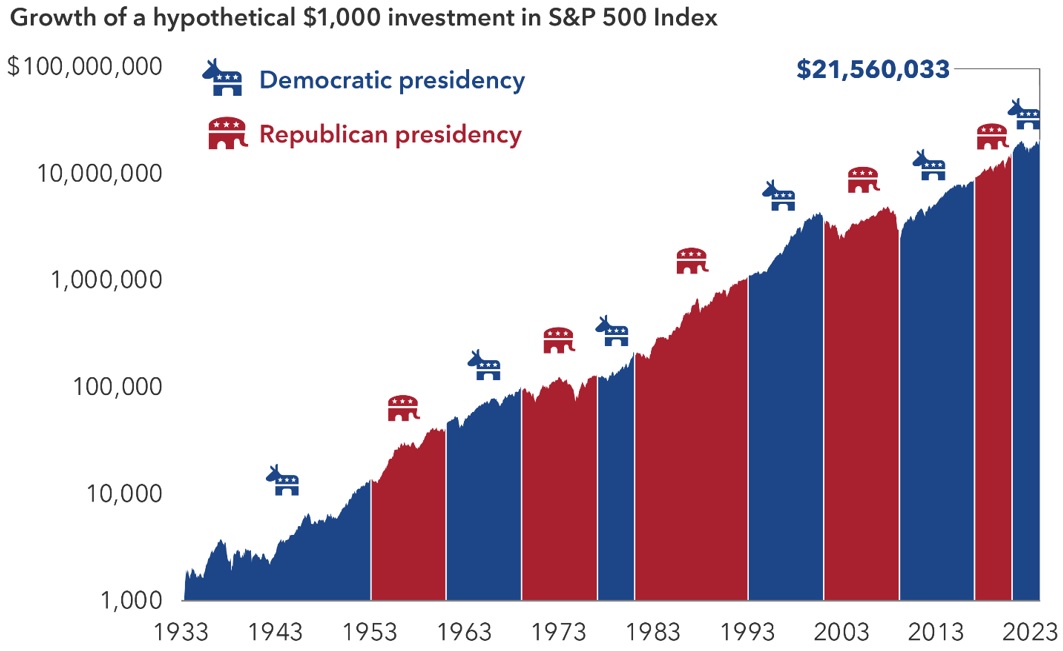

U.S. Stock Market performance under Democratic or Republican Leadership (does it matter?)

The political climate is more chaotic than normal, to say the least. However, when we look back as far as the Great Depression, we see that U.S. leadership has little effect on long-term investment returns.

The key takeaway from the chart above is that that the political affiliation of a U.S. president, whether Democrat or Republican, has little impact on long-term investment returns. The performance of the S&P 500 is influenced by a wide range of factors, making the presidency a relatively minor consideration in overall market outcomes.

While President Trump may govern with a heavier hand, he cannot control every economic factor. Capital Group economist Darrell Spence offered the following:

“Presidents get far too much credit, and far too much blame, for the health of the US economy and the state of the financial markets. There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.”

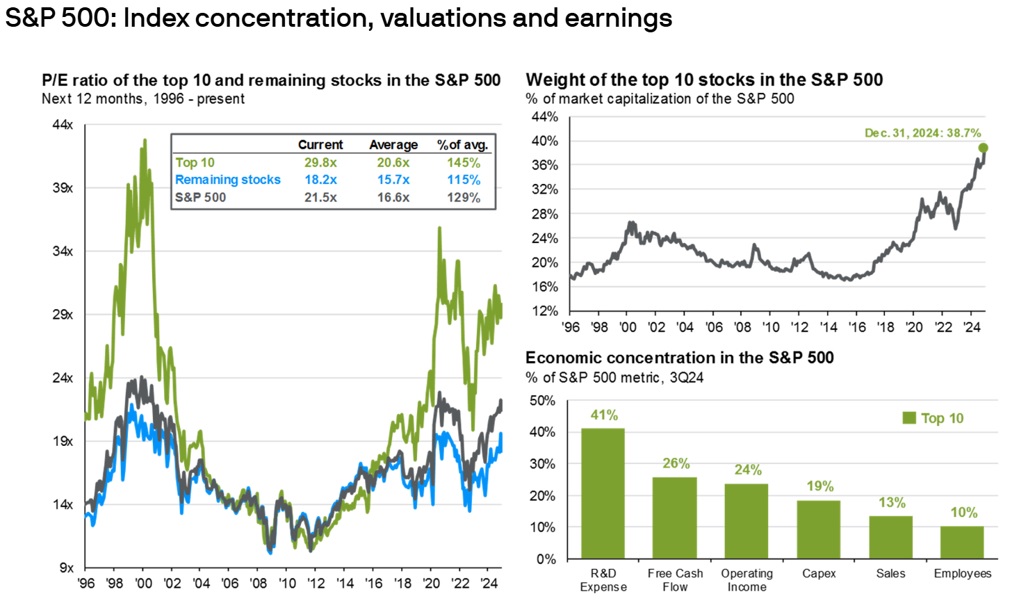

Understand current market concentration

The left-side of chart above illustrates the valuations of the top 10 stocks on the S&P 500 (in green), compared to the rest of the index (the other 490 companies on the S&P 500, in blue) and the index as a whole (in grey). Historically, the top 10 stocks haven’t always traded at higher valuations than the rest of the index. However, over the past five years, the gap has widened as mega-cap tech companies have increasingly dominated. A term commonly used to describe this concentration is “narrow market leadership”.

This trend is reflected in the chart on the top-right, which shows that these top 10 companies now account for almost 40% of the entire S&P 500. The chart on the bottom-right provides context for this dominance: these companies contribute a substantial portion of the market’s free cash flow and operating income. Additionally, their significant investment in R&D highlights the strength of their competitive advantages, suggesting these companies may maintain their market leadership for the foreseeable future.

On January 27, the Nasdaq fell 3% as AI leader Nvidia sank 17%, and it erased about US$593 billion in stock market value, the deepest ever one-day loss for a company on Wall Street. This story serves as a good reminder of the risks of being overly concentrated.

Index concentration can be managed with diversification into other geographies, sectors, and employing the use of active funds that are underexposed to the big U.S. tech stocks.

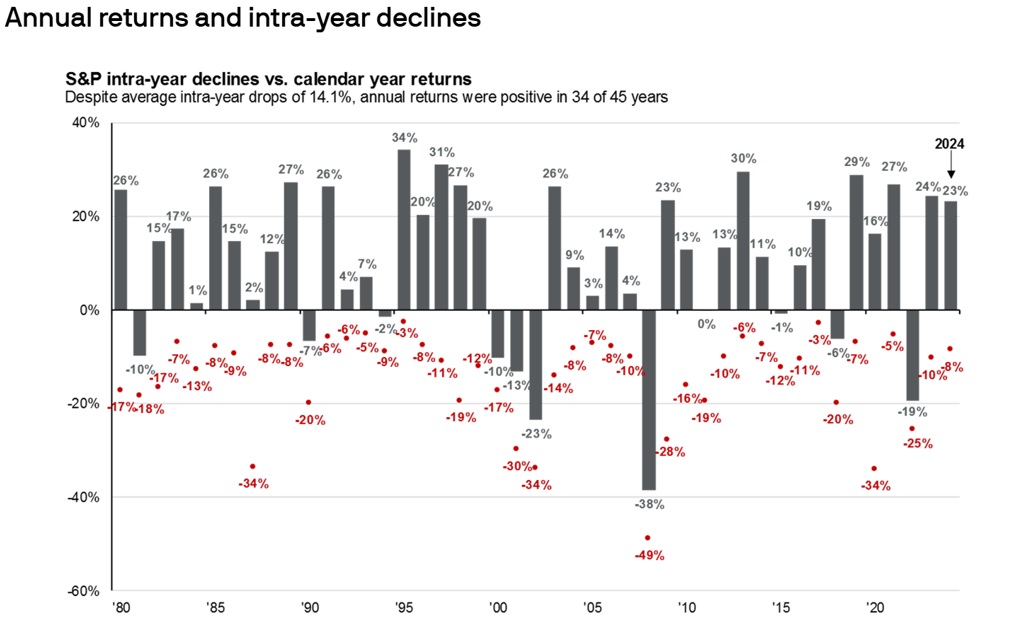

Markets corrections are not a matter of “if”, but “when”

If you invest in a basket of equities, you should expect periods of negative performance. These declines can be shallow or deep, and they can last weeks, months, or years.

The chart above tracks annual returns and intra-year declines. In the past 45 years, the S&P 500 experienced 11 negative calendar year returns, for an average of one negative year every four years. This pattern is also true for the past 100 years of the S&P 500. In other words, there is a historically good chance of a market correction during President Trump’s 2025-2028 term.

You’ll see that markets can experience a significant pullback even when they finish the year in positive territory; for example, 2024 saw the S&P 500 decline 8% in late-July to early-August, despite ending the year with a 25% return.

The Tariff threat – Not all Canadian sectors will be negatively impacted

David Rosenberg, who is known for his conservative market outlooks, published an article in the Globe & Mail on January 21st titled “Trump’s tariffs would be devastating for the Canadian economy – but not for the TSX”. An interesting passage from the article:

“The tariff move would be a negative for the materials, industrials and consumer goods sectors to be sure, but the services side (like the dominant financials space) would not be directly affected and are likely to benefit from lower funding costs and a steeper yield curve. (The cuts by the Bank of Canada would push short-term bond yields down faster than those of longer-term issues.)

Other sectors, such as telecom, REITs and utilities would also benefit from lower rates, and the weaker Canadian dollar would be a boon to domestic players in the travel and tourism industry (air, rail, hotels). These areas command a near-50-per-cent share of the TSX, which outweighs the sectors (roughly 30 per cent) that would be most harmed by the U.S. trade action.

Because the Canadian stock market takes its cue more from the global than from the domestic economy, there is only a 25-per-cent positive correlation between the TSX and GDP growth. That is half the sensitivity to local economic conditions compared with the U.S. relationship between GDP growth and the S&P 500.”

The Canadian dollar – To hedge or not to hedge

The Canadian dollar (CAD) was trading at around 75 cents USD just before the U.S. election, but as soon as Trump raised the tariff threat, it sank to 70 cents USD.

According to Fidelity Investments, “the $CAD will weaken from this point, but we think it’s worth considering when and how you might start to hedge currency for some of your registered account holdings. Many investment funds are made available in an unhedged and hedged version, with the hedged version stripping out the effects of currency fluctuations”.

Interest rates, and therefore savings & GIC rates, are declining

On Wednesday January 29th, the Bank of Canada again cut its overnight interest rate, this time by 0.25%, down to 3.00%. The BoC overnight rate, which peaked at 5.00% in 2022 to fight spiking inflation, has now come down 2.00% in the last 7 months.

Variable mortgage holders have seen their mortgage rate lower with each successive rate cut, and those with expiring fixed rate mortgage terms will see a better renewal rate than if they’d renewed in 2022 or 2023, but the flip side of this coin is that savings and GIC rates are lowering.

High interest savings rates, which (aside from short-term teaser rates) peaked in the 4.75% range in 2022, are now down to the 2.70% range; 1-year GIC rates peaked in the 5.70% range in 2022 and 2023, and now sit in the 3.55% range.

So, what to do with your cash? Simply put, if you have cash on the sidelines you don’t need in the next 2-3 years, you’ll need to move up the risk ladder to generate modest returns. As usual, money set aside for emergency purposes or with defined investment timelines of 3 years or less should remain unexposed to markets.

Implement an “explore” portion to your portfolio (de-risk, growth, theme)

Working with an advisor does not mean you can’t have a personal investment thesis. A popular portfolio construction strategy is the “core” and “explore” approach. For example, you might have 90% of your portfolio deployed in broad market exposure (the “core”), and 10% allocated to an investment idea you really believe (the “explore”).

TD Cowen Research provides an interesting top 10 list of market themes to consider. The list includes themes such as democratizing wealth, obesity, the space economy, biosecurity, and nuclear resurgence.

Please feel free to discuss any personal investment ideas with us. There’s almost always an investment solution we can use to implement your explore theme.

Sources: Advisor.ca, BMO, Capital Group, CNBC.com, Globe and Mail, IA Clarington, Mackenzie Investments, National Bank Asset Management, Russell Investments, TD Asset Management