We hope you and your families enjoyed a happy, healthy, and relaxing holiday season. As we turn the page on 2022 and bring 2023 into focus, here are 15 topics to consider when planning for the coming year.

Markets have been increasing since early-October 2022. On October 12, 2022, the S&P 500 bottomed out – closing at 3,577 – at ~25% YTD down from the late-2021 market peak. Since bottoming, the S&P has increased ~12%, closing at 3,999 on Friday January 13, 2023.

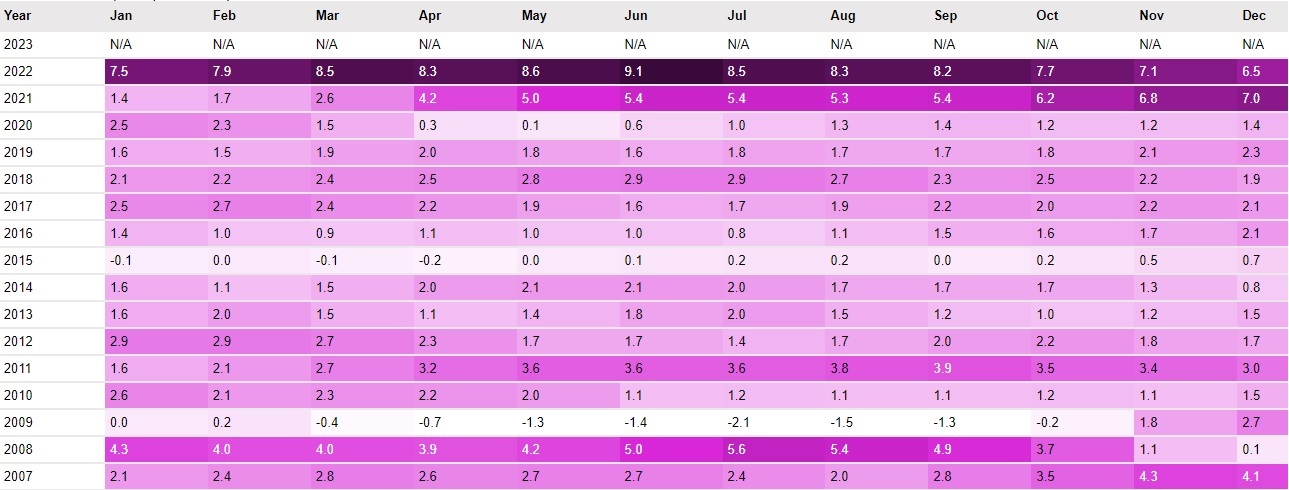

Inflation has been declining since September 2022. The first two points are by design. Inflation and markets were heavily correlated last year and will likely remain so in 2023. The chart below (monthly inflation data back to 2007) shows just how economically inconsistent, and therefore disruptive, the 2022 inflation data was relative to the past decade.

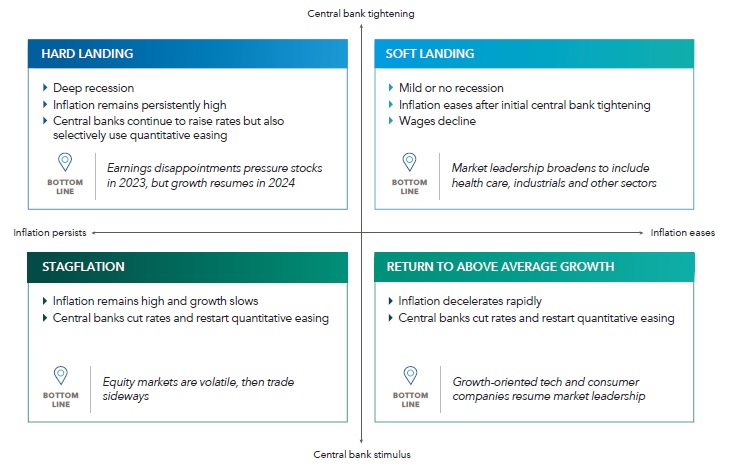

In the battle to tame inflation, prepare for a range of outcomes. Inflation is on the decline, but how long it will persist and how central banks will react have different implications for financial markets.

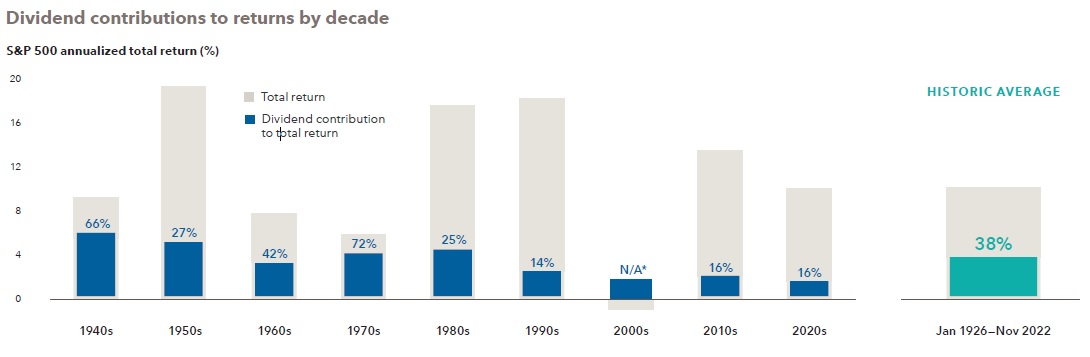

When you can’t count on growth, you can count on dividends. Over the past 100 years, reinvested dividends accounted for over 40% of the S&P 500’s total returns. On a decade-by-decade basis, the dividend return as a percentage of total returns has varied, but the overall conclusion is that dividend holdings compound over time into powerful returns.Dividend equities tick many investment boxes. They are generally safer than the overall market, they are most associated with mature, blue-chip companies, and they are tax-efficient.

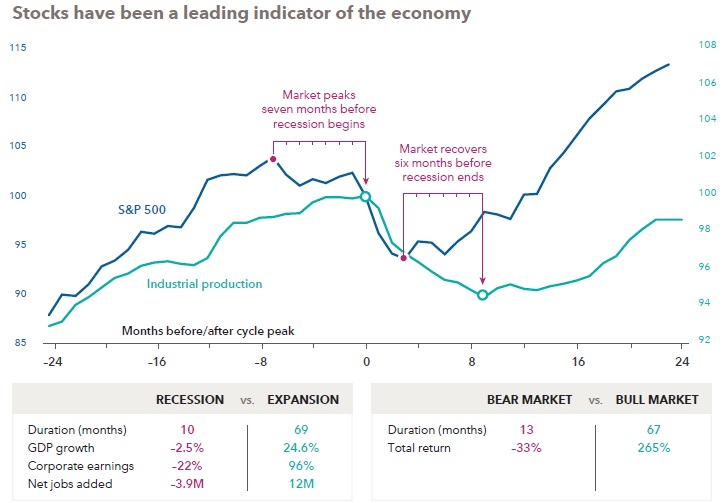

Stocks typically recover before recessions end. Since 1950 in the U.S., over 11 market cycles the average recession was 10 months in length, ranging from two to 18 months. Stock markets tend to recover before recessions end. If history is a guide, we could see a stock market recovery around six months before an economic recovery.Capturing the full market recovery can be a powerful benefit, with U.S. bull markets returning a cumulative 265% on average since 1950 while bear markets saw losses of about 33% cumulatively in the same timeframe. Stay invested!

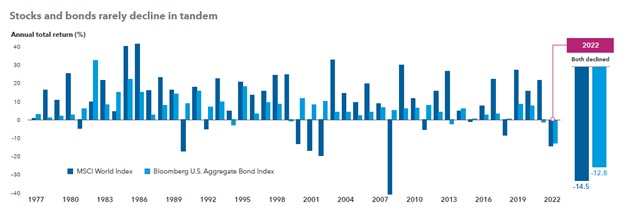

Bonds should once again offer diversification from equities. 2022 was unusual in that equities and bonds had such strong correlation. 2022 was one of the worst years for bonds on record. It is rare for stocks and bonds to decline in tandem as we saw last year; in fact, since 1977, the only exception was 2022. This should change in 2023, with bonds once again offering relief from volatile stock markets.

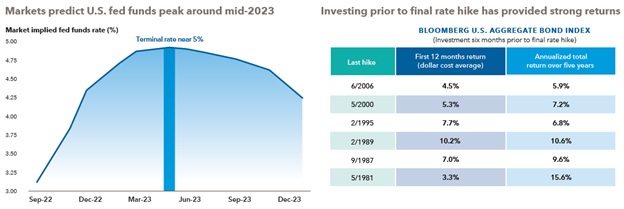

Investing in Bonds prior to interest rate peaks have provided strong historical returns. Aggressive rate hikes throughout 2022 hit bonds hard, hence the double-digit calendar year losses. We may see some additional rate hikes in the near-term, but the worst is likely behind us. Historically, investing in bonds prior to the rate cycle peak has provided strong long-term returns.

Maximize your savings rate. Today, a competitive high interest savings account rate is at least 4% (non-promo rate). If you do not require a portion of your funds and are confident locking in for a year, you can obtain a GIC rate of ~5%.

Big bank savings accounts are currently paying around 1.5%, or 2.5% less than what you could be getting for your short-term cash. That 2.5% difference is an extra $625 in interest for every $25,000 you have in your savings.

We have access to high interest savings and GIC solutions directly through your Investia portfolio without you needing to open a new account or chase down promo rates every few months.

Pay down your debt. The credit and interest rate backdrop changed significantly last year. The 1.49% variable rate mortgage you held in Jan 2022 is now up to 5.49%; the 3% Home Equity Line of Credit (HELOC) is now up to 7%.

Nothing has changed with your fixed-rate mortgage, but you should plan for a higher renewal rate if your current mortgage term started before February 2022.

These higher lending rates result in very different answers to questions like “how much of a home can I afford?”, “should I contribute to my RRSP or pay down my mortgage?”, “should I take out an investment loan?”, etc.

Re-assess your risk tolerance during this backdrop. How were your financial stress levels during last year’s decline, relative to how you answered that risk questionnaire all those years ago? Could you, theoretically, handle a similar portfolio decline in 2023 than in 2022, which is within the realm of historical possibility? If last year’s performance was outside your comfort zone, please contact us to discuss further.

Buy low. For clients who are still in the “accumulation” phase of their investing career, the current market environment continues to provide an attractive entry point for new, long-term money.

Remain Diversified. Against a backdrop rising interest rates and inflation, the commodity-heavy Canada market outperformed the tech-heavy U.S. one. It would be easy to extend that trend to 2023 and assume Canadian will again outperform, but it is impossible to know which geographical region will out-perform and which will under-perform. Historically, we have seen that performance leaders vary from year-to-year. A well-diversified approach is usually best.

What do you want in your explore sleeve? Generally, about 90% of a portfolio should be in core holdings, diversified regionally / sector-wise / equity vs fixed income / individual holdings. The idea is not to place too many eggs in one basket. Usually, the “core” 90% portion of the portfolio is designed to match as close as possible to the index.But what about the remaining 10%? This is what we call the “explore” portion of the portfolio. This portion is often there to implement your personal investment thesis. Do you prefer a higher exposure to tech? commodities? previous metals? Banks? Infrastructure? Green energy? Crypto? Something else?

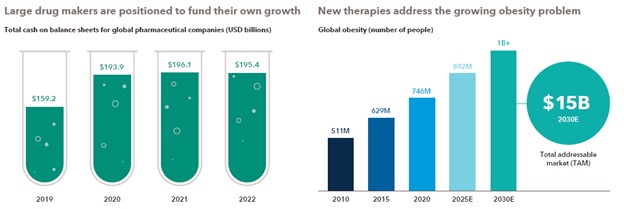

Will Healthcare lead the next bull market? Usually, a new sector leads the way coming out of a bear market. Companies with strong, reliable cashflows are favourably positioned to take the lead when markets recover. The healthcare sector features innovative pharmaceutical companies that are well-capitalized and have pricing power and can use near-term profitability to fund acquisitions and other growth strategies.

The market declined in 2022, but your plan has not changed. A globally diversified growth-oriented portfolio of around 80% equites and 20% fixed-income has returned around -10% in the past year, 3% annualized in the past 3 years, and 6% annualized in the past 10 years, which is a historically very normal short-, medium- and long-term sequence of returns. It’s the type of return sequence we project for in your retirement cash flow projections.

As always, we welcome your feedback. Please let us know if you have questions or concerns about your portfolio, markets, long-term vs short-term strategies, or anything else we may be able to assist with.

Sources: Morningstar, Yahoo! Finance Canada, Capital Group, Stocksera.com